Taxes

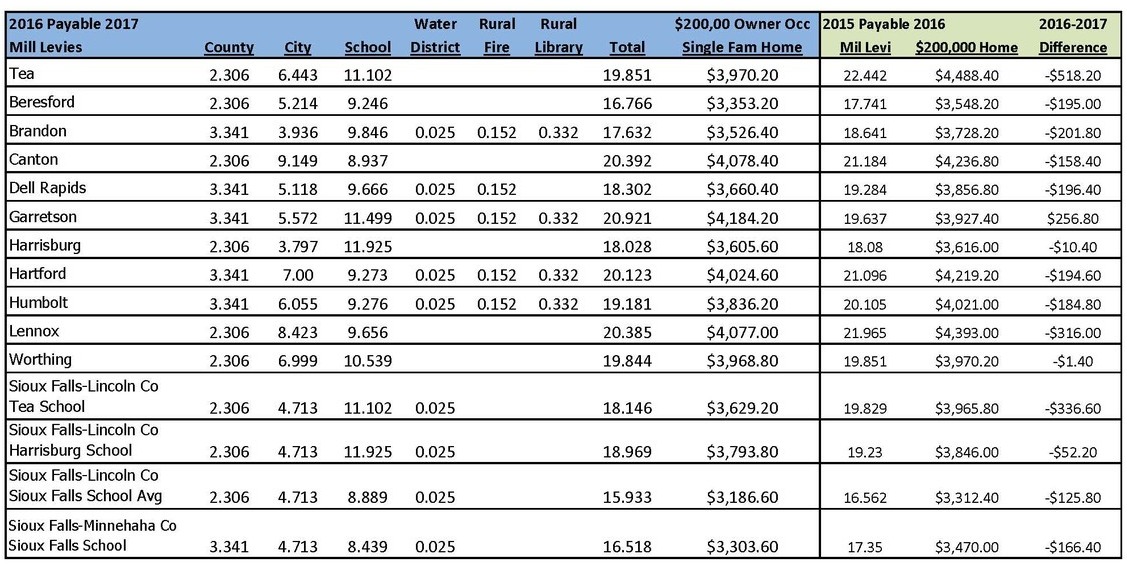

Community Property Tax Comparison

City of Tea Sales Tax

- 4.5% State

- 2% City

- 1% City (on Prepared Food Beverages)

Property Tax Owner Occupied Home

Total of $19.851 per $1000.00 Assessed Value (2016 Taxes payable 2017)

EXAMPLE:

Owner Occupied Home appraised at $200,000 taxable value

- Tea City: 6.443 x 200 = $1,288.60

- Lincoln County: 2.306 x 200 = $461.12

- Tea Area School: 11.102 x 200 = $2,220.40

- Total 19.851 = $3,970.20 Property Taxes Per Year

The total City of Tea mill levy is slightly higher than many other communities, however, it should be taken into account that Tea has the lowest water and sewer rates within our area. Once figuring in the lower monthly water sewer costs and looking at the many amenities Tea has to offer, the City of Tea is in line with other surrounding communities.